In the 1930s, an accountant named Ralph Nelson Elliott discovered a startling pattern in the stock market. He realized that market prices do not move randomly, but rather in repetitive cycles driven by mass investor psychology. He observed that these cycles repeated themselves on every timeframe, from the monthly chart down to the 1-minute chart. This concept, known as “fractals”, patterns that look the same at any scale, forms the basis of the Elliott Wave Theory. For modern traders, mastering this theory provides a framework for predicting where the market is in its cycle and where it is likely to go next.

The 5-3 Wave Structure

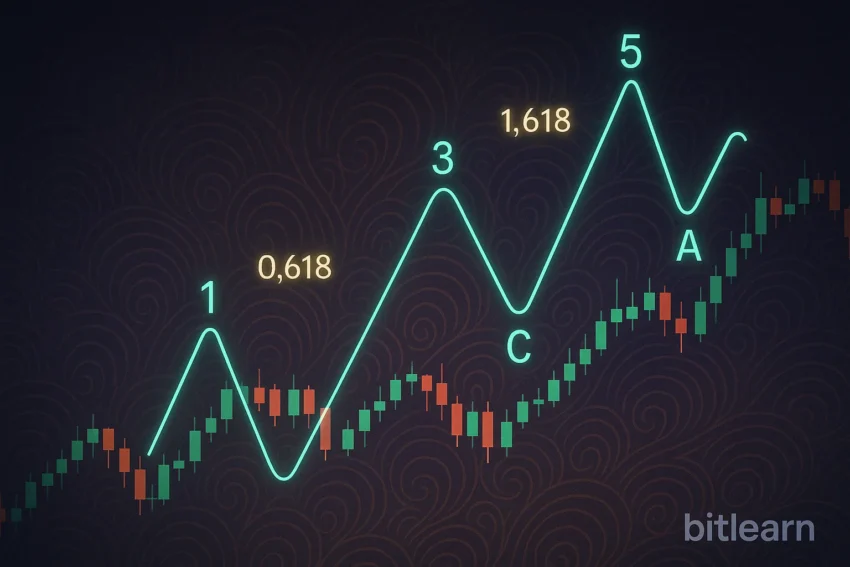

The core tenet of Elliott Wave Theory is that trends move in a “5-3” pattern.

- The Motive Phase (5 Waves): The primary trend unfolds in five distinct waves. Waves 1, 3, and 5 move in the direction of the trend (impulse waves), while Waves 2 and 4 move against the trend (corrective waves).

- The Corrective Phase (3 Waves): After the five-wave move is complete, the market corrects in a three-wave counter-trend structure, labeled A, B, and C.

This 5-3 pattern creates a complete cycle. Crucially, each of these waves can be broken down into smaller 5-3 patterns. For example, Wave 1 is itself composed of five smaller sub-waves. This fractal nature allows traders to “zoom in” and “zoom out” to find trading opportunities on any timeframe.

Psychology Behind the Waves

Elliott Wave is not just about drawing lines; it’s about psychology.

- Wave 1: The “Smart Money” stealthily accumulates positions while the crowd is still bearish.

- Wave 2: A scary sell-off that tests the resolve of the early buyers, but doesn’t make a new low.

- Wave 3: The “Crowd Wave.” This is usually the longest and strongest wave. The news becomes positive, and the masses rush in.

- Wave 4: Profit-taking by smart money creates a choppy consolidation.

- Wave 5: The “FOMO Wave.” Prices make new highs on lower volume and diverging momentum. This is the final speculative frenzy before the crash.

Fibonacci Ratios: The Mathematical Backbone

Elliott Wave Theory is deeply intertwined with Fibonacci ratios. The waves often relate to each other by specific mathematical percentages. For example, Wave 2 often retraces 61.8% of Wave 1. Wave 3 is often 1.618 times the length of Wave 1. Traders use these Fibonacci levels to set precise entry orders and profit targets. This mathematical precision brings structure to the chaos of the market and is a key component of advanced Technical Analysis.

Application in Modern Markets

While created for the stock market, Elliott Wave works exceptionally well in crypto and forex because these markets are driven heavily by retail sentiment and crowd psychology. Identifying that a market is in a “Wave 3” can give a trader the confidence to hold a position aggressively, while recognizing a “Wave 5” can warn them to tighten stops.

To apply this theory effectively, traders need a charting platform with robust drawing tools. The YWO trading platform offers the advanced annotation capabilities required to map out these complex wave structures, helping traders surf the psychological tides of the market.

Vanna Berkey is a young, ambitious woman who has a passion for blockchain technology and cryptography. She has been working in the cryptocurrency industry since she was 18 years old, and is an expert in blockchain algorithms. Vanna is determined to use her knowledge and skills to make a positive impact on the world.