For those new to financial markets, the chaotic price movements of cryptocurrencies can seem utterly random. However, for over a century, market analysts have developed theories to identify underlying patterns and structures within this apparent chaos. Two of the most enduring and powerful methodologies are the Wyckoff Method and Elliott Wave Theory.

While complex, a foundational understanding of these concepts can provide traders with a sophisticated lens through which to interpret market psychology and anticipate major trend shifts. These are not simple indicators but comprehensive frameworks for understanding the narrative of the market, driven by the collective behavior of its participants.

The Wyckoff Method: Uncovering the “Composite Operator”

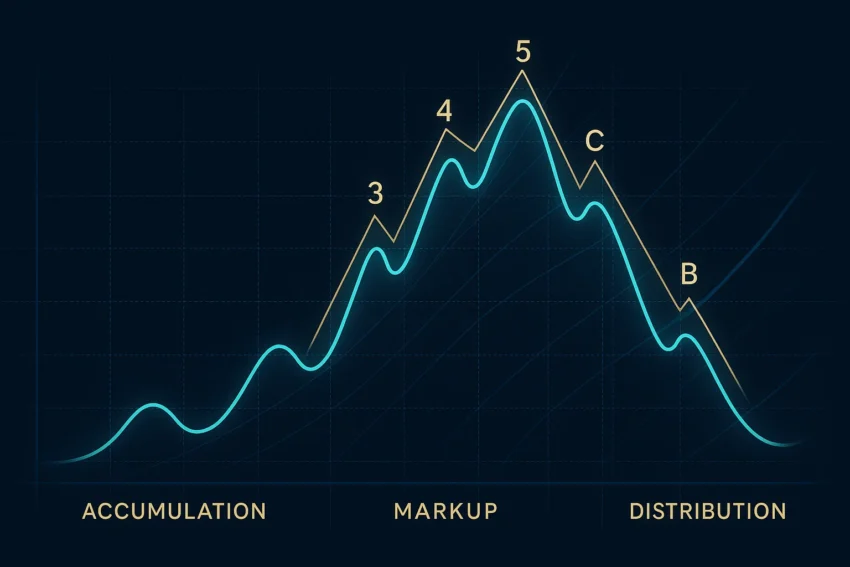

Developed by Richard Wyckoff in the early 20th century, this method is based on the idea of a “Composite Operator,” a conceptual entity representing the collective actions of the largest, most informed market players (or “smart money”). Wyckoff theorized that by analyzing price action and volume, one could discern the intentions of this Composite Operator and trade in harmony with them. The method breaks down market cycles into four distinct phases:

- Accumulation: A sideways, range-bound phase where smart money quietly buys assets from uninformed participants, absorbing supply without causing a significant price increase. This phase is characterized by decreasing volatility and is often seen as the “bottoming” process.

- Markup: Following accumulation, the path of least resistance is upward. This is the classic uptrend, where prices consistently make higher highs and higher lows. Public participation increases as positive news and sentiment grow.

- Distribution: At the market top, the Composite Operator begins to sell their holdings to the enthusiastic but late-arriving public. This phase mirrors accumulation, appearing as a sideways range where demand is gradually overwhelmed by supply.

- Markdown: Once the smart money has largely exited, the market is heavy with supply and begins its downtrend. Prices fall, and public participants, who bought near the top, often panic-sell, exacerbating the decline.

Understanding these phases allows a trader to identify where they are in a market cycle and make more strategic decisions, such as avoiding buying into a distribution phase or recognizing the subtle signs of accumulation. This deep analysis of price and volume is a cornerstone of advanced Technical Analysis.

Elliott Wave Theory: The Rhythm of Market Psychology

Developed by Ralph Nelson Elliott in the 1930s, this theory posits that market prices move in recognizable, repetitive patterns, or “waves.” These patterns are a reflection of the natural rhythm of mass human psychology, which swings from pessimism to optimism and back again. The foundational pattern consists of five “impulse waves” in the direction of the main trend, followed by three “corrective waves” against it.

- Impulse Waves (1-2-3-4-5): Waves 1, 3, and 5 are motive waves that drive the price in the direction of the primary trend. Waves 2 and 4 are corrective waves that move against the trend. Wave 3 is typically the longest and most powerful wave, representing the point of strongest market conviction.

- Corrective Waves (A-B-C): Following the five-wave impulse sequence, a three-wave correction occurs. This pattern can take many forms (such as a zigzag or a flat), but it serves to retrace a portion of the gains made during the impulse phase.

A key principle of Elliott Wave is its fractal nature: these 5-3 patterns appear on all timeframes, from 1-minute charts to monthly charts. An Elliott Wave practitioner attempts to identify their current position within this larger structure to forecast the market’s most likely next move. This requires a high degree of skill and practice, but it can provide a powerful roadmap for future price action.

Integrating Advanced Theories Into a Modern Framework

Neither Wyckoff nor Elliott Wave should be used in isolation. They are most powerful when combined with other forms of analysis and a robust risk management strategy. A trader might use the Wyckoff phases to determine the overall market environment (e.g., accumulation) and then use Elliott Wave counts to identify precise entry points within that phase.

This layered approach, which combines macro context with micro timing, is a hallmark of professional trading. While mastering these theories takes time, even a basic familiarity can elevate a trader’s understanding of market structure and the psychological forces that drive it. This advanced perspective is critical for anyone looking to go beyond basic indicators and truly understand the story the market is telling.

Vanna Berkey is a young, ambitious woman who has a passion for blockchain technology and cryptography. She has been working in the cryptocurrency industry since she was 18 years old, and is an expert in blockchain algorithms. Vanna is determined to use her knowledge and skills to make a positive impact on the world.